Informal Enterprises Overcoming Formal Finance Challenges: Is the Digital Gambit Working?

Informality amongst small businesses hinders their productivity and restricts scale opportunities for growth. While challenges from survival to sustenance could be many, their structured and rigorous empirical exploration remains scanty in the absence of robust data. Global surveys amongst informal enterprises have identified several obstacles to their growth, key amongst them being corruption and access to formal finance.

Given the significant impetus on entrepreneurship and Atmanirbharta by the government, creating an enabling environment for small businesses is an utter and urgent necessity. Based on the analysis if World Bank Survey data, the present study impresses upon the relevance of short-term (day-to-day/working capital) formal financing solutions in augmenting sales and productivity of such small businesses. It further highlights that modern era digital communication tools and digital payment solutions act as enablers to such financial access, thus providing validation to the government’s multiple initiatives on firm formalisation through the Digital elixir.

India has a significantly large informal sector consisting of unincorporated enterprises, mostly operating as proprietary businesses), employing approximately 73% of its total eligible workforce and contributing nearly half of the measured economic activity (NSO-PLFS, 2024; NSO-ASUSE, 2024). Studies show that informal businesses are typically characterized by staying unregistered, operate from households and manage mostly though self or informal finance. They lack market access, and suffer from skills shortfall and lately poor technology adoption, which curtails their “opportunity basket”. Despite the challenges however, these businesses on their own are not forthcoming to register, citing reasons like high cost of registration and compliance, literacy, tax incidences and many times just overall lack of awareness.

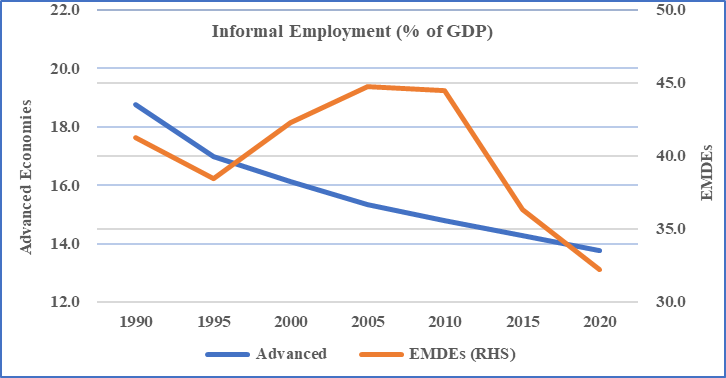

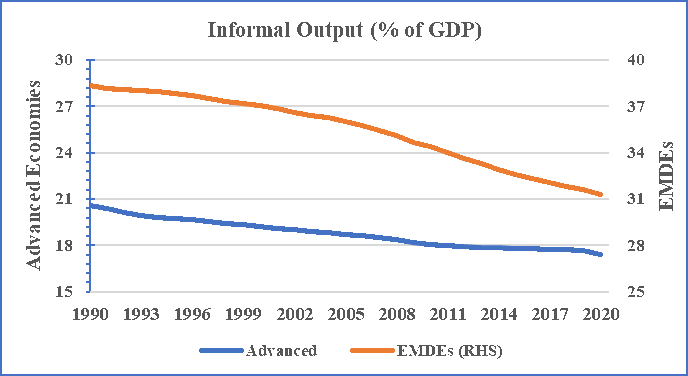

Identifying the importance of their economic contribution and in order to bridge the overall productivity gap, firm and employment formalization has been at the forefront of country’s economic agenda. Through its multipronged approach and under its “Digital India” program which started in 2015, the government has been focussing on easing out the business registration process (UDYAM portal, 2020), facilitating efficient digital infrastructure (UPI in 2016, GST in 2017) and enhancing market access (GeM portal for MSMEs, 2017) for informal businesses. These formalisation initiatives are further linked to improved financial access and higher social security benefits to informal workers. Globally, the share of informal economy has been declining, more steeply for emerging markets and developing economies (EMDEs) as shown vide Figure 1 and 2.

Figure 1: Informal employment trend, measured through self-employment as a % of GDP for 1990-2020.

Source: Authors’ own work. Computed from World Bank database, World Economic Outlook Database, 2023 – Groups and Aggregates.

Figure 2: DGE model based Informal Output trend, measured as a% of GDP for 1990-2020 (DGE=Dynamic general equilibrium).

Source: Authors’ own work. Computed from World Bank database, World Economic Outlook Database, 2023 – Groups and Aggregates.

In India too, Increasing job-contract issuances over the past 5 years, leading to an almost 10% drop in workers engaged “without a formal job contract” and a slight reduction of 0.8% amongst those erstwhile excluded from social security benefits as well, provide evidence to the fact. (Table 1)

Table 1: Employment in informal sector and Firm digitalization

| Percentage of workers* | 2019-20 | 2020-21 | 2021-22 | 2022-23 | 2023-24 |

| Informal sector workers % | 69.5 | 71.4 | 71.8 | 74.3 | 73.2 |

| No written job contract | 67.3 | 64.3 | 62.0 | 58.6 | 58.0 |

| No social security benefit | 54.2 | 53.8 | 53.0 | 53.9 | 53.4 |

*Workers above 15 years of age

Source: Authors’ own work. Computed from PLFS, 2020-21, 2023-24, and ASUSE, 2023-24.

Empirical evidence is however scarce and inconclusive as far as the relationship of digitalization with small enterprises’ performance (ICT-Productivity paradox). Again, small firms remain ambiguous between formal and informal finance due to their differentiated utility and impact on performance based on firm’s operating stage, urgency of funds requirement, availability of collateral and cost of financing. This study therefore, picks up these gaps on digital and formal finance adoption amongst informal enterprises to ascertain their impact on firms’ productivity and sales performance. It uses a country-wide survey based World Bank dataset (2022) to drive its analysis thus adding empirical value to our knowledge on what drives informal businesses.

The survey captured responses from 10,672 legally unregistered informal businesses (identified as not having a minimum of PAN registration). In India, manufacturing enterprises below the aggregate annual turnover of rupees four million (rupees two million for service sector) are exempted from registering under GST Act, 2017, thereby covering almost all of the informal enterprises under this threshold.

In small businesses, primary owner remains pivotal to key business decisions and owner– manager characteristics like age, education, gender and industrial expertise, amongst others could play significant role in availing credit, technology usage and eventually enterprise performance. Higher education remains a challenge with just 12% found having a diploma with only about 32% maintaining written business records. The evident lack of adequate formal education could impede with firm’s record keeping practices and aggravate information opacity issues when it comes for accessing formal finance.,

When it comes to financing, a large 78% were found to rely on their own funds to start operations citing formal finance as a key challenge, while a whopping 93% relied on informal channels for seed money. Digital engagement finds a robust presence though with an approximately 58% firms using digital payment channels for business activity viz. making (to suppliers) or receiving payments. Younger firms and those with higher levels of owners’ education were found to have higher digital adoption and prefer using external formal working capital finance (both formal and informal).

Significant gender disparity is observed amongst informal businesses with just 10% representing women ownership. Further, Female ownership finds association with lower sales and firm productivity highlighting lack of sizeable opportunities to build scale.

Interestingly, corruption (informal payments) finds positive association with sales thus corroborating “greasing the wheel” hypothesis for operations and growth at these levels.

It is acknowledged that accessing formal finance remains inherently challenging for small businesses on account of information asymmetries. Counter-intuitively and despite its cost-inefficiencies, small business owners could prefer informal financing channels relying on their cognitive financial constraints, entrepreneurial orientation, ease of availability and perceived repayment flexibilities involved therein.

However, the study highlights that businesses having digital and formal working capital finance adoption perform relatively better in terms of both sales (3%–9%) and labour productivity (1%–7%), over the chosen time periods supporting the use case for formal finance and digital adoption The digital transactions trail thus generated can further help formal lenders better. analyse business activity to provide digital data driven and cash-flow-based financing.

The study provides significant insights into informal firms ‘ characteristics, laying stress on their inherent practical challenges towards adoption of formal finance and digital channels of business engagement. Laying stress on such nuanced yet less-explored behaviour of digital payments association with access to formal working capital finance , it crucially finds that both direct and interaction effects of digital payment and formal working capital finance adoption have consistently positive impact on firm performance.

It advocates for higher formal education amongst business owners which could further help with business record keeping and improved capabilities for digital skills enhancements eventually reducing information asymmetries, making formal finance more accessible and thus also solve lack of capital issues.

The results clearly suggest to the transformative role of government policies in encouraging digital payments amongst informal businesses. Reliable and affordable digital infrastructure across rural and semi-urban areas, targeted measures to enhance digital literacy amongst owners and employees of small business can further help secure higher adoption rates, thus encouraging firm formalization as well.

Further, government supported digitally enabled finance and e-commerce platforms (e.g. TReDs, GeM) have been found to significantly benefit small enterprises both in terms of market access and improved working capital management through faster cash-flow realisations. Their usage must be continuously further encouraged through appropriate incentives including credit guarantees, and sector-focused product and raw material cost subsidies as applicable.

Unarguably, this point-of-time study would have its limitation when it comes to undertaking impact analysis. Therefore, longitudinal research could be encouraged here to ascertain the determinants and digital and formal working capital migration effects on growth as informal businesses formalize. Future research can also expand the scope through comparative analysis between unregistered and registered microenterprises by employing broader samples to expand generalizability, and/or explore financial and digital adoption variance based on sectoral anad geographic classification within the country set-up.

<p>The post Informal Enterprises Overcoming Formal Finance Challenges: Is the Digital Gambit Working? first appeared on Hello Entrepreneurs.</p>